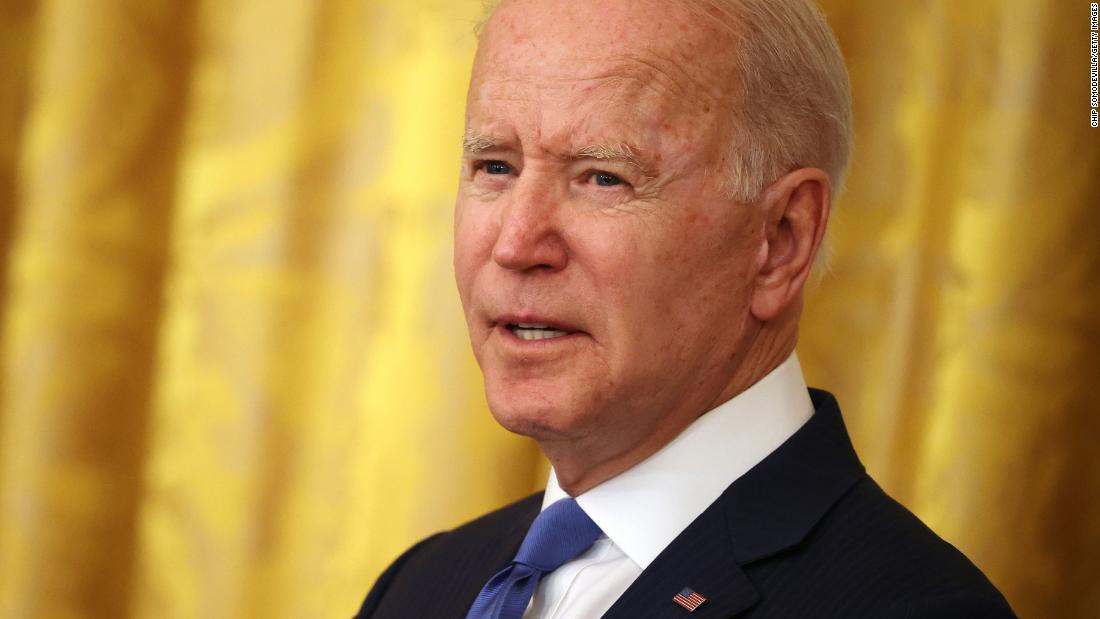

“The President will provide an overview of how some families may use this money, from basics like food and housing to new school supplies or after-school activities,” the official told CNN in an exclusive preview Wednesday evening.

Starting Thursday, the White House says, American families should expect to see payments on the 15th of every month — providing them with extra funds — through the end of 2021, with an accompanying tax break when they file their returns next year. The vast majority of families — roughly 39 million households, covering 88% of children — will get the credit automatically because they filed 2019 or 2020 returns claiming the credit. Families that file taxes electronically should see payments in their accounts Thursday that say “CHILD CTC,” while families that file via mail should expect checks in “several days,” per the administration.

The White House projects the payments will be “transformative” for families, leading to “the largest-ever one-year decrease in child poverty in American history,” the official said.

In his remarks highlighting the credit Thursday, Biden “will highlight the adjustments that were made to the CTC so that the families that need help the most get the full amount of this tax cut, as well as the return on investment it provides for our nation’s children.”

“For the first time in our nation’s history, American working families are receiving monthly tax relief payments to help pay for essentials like doctor’s visits, school supplies, and groceries,” Treasury Secretary Janet Yellen said in a statement Wednesday evening. “This major middle-class tax relief and step in reducing child poverty is a remarkable economic victory for America — and also a moral one.”

The full enhanced credit will be available for heads of households earning $112,500 and joint filers making up to $150,000 a year, after which it begins to phase out.

For many families, the credit then plateaus at $2,000 per child and starts to phase out for single parents earning more than $200,000 or married couples with incomes above $400,000.

More low-income parents will become eligible for the child tax credit because the relief package makes it fully refundable. It had been only partially refundable — leaving more than 26 million children unable to get the full credit because their families’ incomes were too low, according to Treasury Department estimates.

The President will also use part of his remarks Thursday to “underscore the importance of passing the American Families Plan as part of his full Build Back Better agenda to make sure this tax cut will continue for working families for years to come,” the official told CNN on Wednesday.

More News

Turning Point or Breaking Point? Biden’s Pause on Weapons Tests Ties to Israel

But How Does the Worm Get in Your Brain?

Greene Moves to Oust Johnson, Teeing Up Another Historic Vote