Reaching ‘net zero’ carbon emissions requires doing more than curbing greenhouse-gas emissions. Carbon dioxide must also be withdrawn from the air to compensate for continued releases from sectors in which emissions are hard to abate, such as cement and steel production1,2.

There are many ways to do this — from extracting CO2 directly from the air by chemical means to planting trees and seagrass, or seeding the oceans with iron to stimulate the growth of photosynthesizing phytoplankton. Even with full decarbonization, billions of tonnes of CO2 will need to be locked away each year — a tonnage equivalent to all of the food or concrete produced in the world annually.

Markets in ‘carbon offsets’ — credits that pay someone else to reduce atmospheric carbon on your behalf — can be an effective way to manage CO2 removal globally. But they will work only if the prices and incentives are right, and there are currently two fundamental problems with how they are set up.

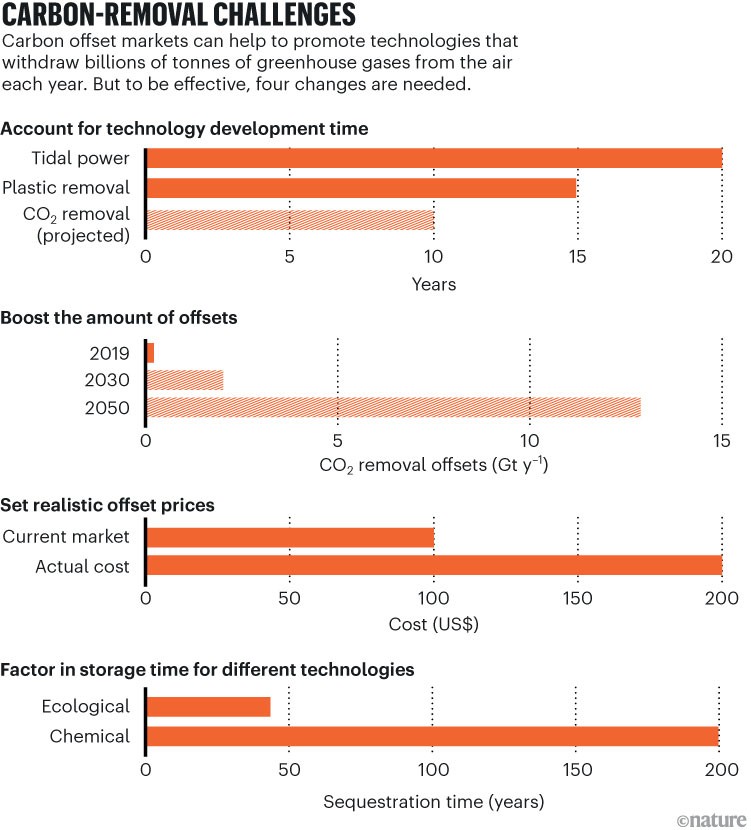

First, at least 90% of the offsets traded3 in the voluntary market are not for removing carbon at all, but for avoiding its release. Foresters, for example, are paid to not chop down trees. These offsets do little to lower CO2 levels in the air and should be replaced with those that facilitate proper removal3,4. The amount of carbon offset also needs to grow at least 15-fold from current levels (mainly based on avoidance offsets) to meet a projected demand for carbon-removal offsets of 1.5 billion to 2 billion tonnes of carbon dioxide per year in 20303.

Second, the price put on locking away one tonne of carbon is meaningless. Every approach to carbon removal differs in its stage of maturity1,2, in how much it can be scaled up, in how effectively it removes CO2 and for how long, and in the costs involved. Different approaches are thus hard to compare. Markets don’t know whether the method used is reliable4, and no timescale is attached. Current offsets treat one tonne of carbon removed as one tonne, whether it is sequestered for a few years or for 100.

Prices are similarly vague. Depending on where the purchase is made, the market price can range from under US$10 per tonne for some nature-based offsets to around $100 per tonne in European Union markets, for example. That’s less than the expense of removing one tonne of CO2, which currently exceeds several hundred dollars for any method. Such low market prices are in part a legacy of the current reliance on avoidance credits, which essentially have little or no cost to implement.

Three climate policies that the G7 must adopt — for itself and the wider world

Thus, the markets are not pulling in the scale of investment needed to protect the climate. In particular, they are starving the most effective and durable methods of the funding they need to scale up quickly. A ‘gold rush’ mentality is also generating confusion around the value and efficacy of the offsets — hundreds of companies and venture capitalists are moving into the sector, which is projected3 to be worth $50 billion annually by 2030, and eventually one trillion dollars per year.

A long-term, unified vision for a global carbon-removal market is urgently needed to meet projected demand3 and to underpin CO2 emissions reductions. Otherwise, the whole enterprise could founder amid industry tensions, scientific uncertainty and public scepticism.

Researchers must step up now to help shape carbon-removal markets and to be ready for the larger-scale projects that will come online in a decade’s time. They need to design incentives to encourage the uptake of ‘blue-chip’ offsets that invest in durable, safe and verifiable technologies; robust monitoring, reporting and verification processes to assure developers and buyers; and a warranty system to guarantee the provenance of each removal offset (see ‘Carbon-removal challenges’). Here we set out four basic ingredients of such a system.

Sources: Tidal power, ref .12; Plastic removal, go.nature.com/45FKOVU; Offset Boosting, ref. 3; realistic costs, Market data from Live Carbon Prices Today, Actual costs from go.nature.com/3P6tUCB; storage time, Ecological data from ref. 6, Chemical data from ref. 2.

Price offsets according to quality

Not all offsets are equal. In our view, they should have a spectrum of costs, reflecting the diversity of carbon-removal approaches, rather than a single price for removing one tonne of CO2. This spectrum could mirror the market for insurance products, in which cover ranges from third party to fully comprehensive, and the quality of the product is scaled to the cost and linked to risk.

But how can the market judge these costs? First, sequestration time must be factored in. This could be done by pricing the removal of one tonne of CO2 for one year — a ‘carbon offset year’— rather than just the volume of CO2. This metric is already used when discussing storage in the context of the carbon cycle. Adopting it would deliver greater returns for blue-chip offsets that lock away carbon verifiably and at low risk for centuries or more, thereby steering investment towards the most effective projects.

EU climate plan sacrifices carbon storage and biodiversity for bioenergy

Long-term storage is most feasible with geological reservoirs or chemical storage techniques2. Biological storage in particles, sediments and trees in seas, wetlands and forests is more complex to manage5, but the ocean, for, example, has the potential to hold carbon for decades6. Such biological solutions will still be needed in the short term, especially to help manage carbon in situations such as deforestation, as long as carbon is accounted for accurately.

Offsets would also need to factor in uncertainties in the duration of storage, through warranties that compensate for changes in the value of carbon removal. Researchers need to design methods for evaluating these uncertainties. For durations of more than a decade, demonstrations require extensive modelling6.

Use taxes and subsidies

To qualify as high-quality, offsets must be based on durable, safe and verifiable carbon-removal techniques. Definitions of high and low quality need to be set now, to drive necessary action towards high-quality offsets. Incentives will be needed to boost both the quality and quantity of offsets. These aspects could conflict, and research and modelling will be needed to help design markets optimally.

Policies such as carbon pricing, net-zero requirements and cross-border taxes linked to the carbon embedded in imported products are necessary but not enough, because they don’t distinguish between low- and high-quality offsets. Governments will need to intervene7, such as by offering subsidies for carbon offsets that deliver large and long-lasting removals, as well as by funding research to develop and scale up such methods.

Modelling would be needed to inform the size and targeting of subsidies and taxes. In general, offsets whose quality is well established should receive greater incentives.

Regulators would need to rate the quality of offsets, factoring in how much CO2 is withdrawn, for how long and with what uncertainty. Such a system could mirror that used for rating the energy efficiency of electrical appliances.

Adapt current observing networks

A globally consistent framework needs to be designed for monitoring, reporting and verifying offsets so that it is possible to judge the durability of carbon-removal measures and any side effects or unintended consequences. The framework must be capable of working across many technologies and approaches, to build public trust and allow direct comparisons. If proponents of the various technologies each focus on their own area, with no crosstalk or agreement, then quality assurance could not be traced across all the methods and would therefore be unlikely to be widely accepted.

Such a system could be developed within a decade by piggybacking on existing and planned networks, such as those for monitoring the hole in the atmospheric ozone layer, methane emissions and carbon stocks in the ocean. For example, some 50 countries contribute ozone observations to the World Meteorological Organization’s Global Atmosphere Watch Programme. For methane, revised, satellite-based estimates of global concentrations found that 2021 emissions were 70% higher than the cumulative tally from national reports, demonstrating the need for interoperable observational systems8.

Cores extracted from tidal seagrass can be used to assess carbon sequestration rates.Credit: I. Noyan Yilmaz/Science Photo Library

Combinations of satellites9 and drones can monitor carbon fluxes through the air, land and ocean. Satellites can resolve terrestrial carbon at hectare scales9, and drones can reach finer resolutions. Challenges include linking carbon flows across scales, interoperability8 between sensors and unequal spatial coverage across regions.

For the ocean, the ARGO robotic profiling float network might be extended. It is global, involving at least 30 countries, which act independently but operate under the principles of open access and interoperability. Together, on a budget of $40 million annually, they provide 12,000 data profiles each month. Importantly, ARGO has a wide and long-standing link to policy through the Group of 7 (G7) advanced economies, which could advocate to expand the network, at a projected cost of around $100 million annually, across nations to include the costs of sensors, data processing and interpretation.

These services could include more new sensors, machine learning and modelling10. The establishment of an open-access processing system to contextualize observations related to carbon removal, such as establishing a background benchmark10 against which to detect CO2 removal, would be a big incentive for companies to buy in, in return for adhering to an international regulatory framework.

Make use of warranties

Warranties are essential to ensure that the seller’s stated amount of carbon is removed reliably for at least the period claimed. They are widely used in contract law, and in an environmental context through indemnity agreements, to provide security and protection from losses or damage caused by environmental contamination or disaster.

A warranty must also account for risks around the failure to remove enough carbon, and for unexpected side effects and other issues. For example, bioenergy with carbon capture and storage (BECCS) technologies could compete with the food sector over land use. The scale of the warranty would be directly related to the size of the uncertainty envelope in how effective the method is in locking away carbon. Improvements in models11 and in observational coverage would gradually reduce uncertainty envelopes and reveal side effects.

Make greenhouse-gas accounting reliable — build interoperable systems

The warranty approach means that proponents must reveal the uncertainty of their carbon-removal methods. This would need to be cross-checked by an independent verification body and reflected in guaranteeing the price of an offset. To provide confidence in the market, a warranty would have to be accredited through independent international bodies, such as the International Sustainability Standards Board. It was established in 2021 at the UN Climate Change Conference (COP26) to deliver a global baseline of sustainability disclosure standards that would meet capital market needs, which were issued in June 2023.

Inclusion of uncertainty and risk under a warranty would support a diverse range of carbon-removal methods with different unknowns in one market. It would recognize that some approaches could be overly optimistic about their delivery, whereas others have a high degree of uncertainty owing to environmental complexity4, including ocean-based technologies such as iron fertilization. In practice, some methods might prove so unreliable that they cannot compete in the market.

Further measures might be needed in the short term, until blue-chip offsets become available. Interim instruments that might be explored include ‘blended removal’ offsets, where short-term, readily available options, such as increasing soil carbon, are combined with longer-term, long-duration methods, which would take over in time. Others include advance purchase options, akin to those used to fund the development of vaccines but targeted at the most durable (high-value) methods, in terms of carbon offset years, to recoup funds.

Such issues must be agreed on internationally and quickly. The United Nations ‘No-Nonsense’ Climate Ambition Summit in New York City on 20 September, before the COP28 meeting in Dubai in the United Arab Emirates, would be an ideal forum to agree a credible framework with the aim of establishing a nascent market from 2025.

More News

Author Correction: Stepwise activation of a metabotropic glutamate receptor – Nature

Changing rainforest to plantations shifts tropical food webs

Streamlined skull helps foxes take a nosedive