Fossil-fuel production must fall imminently for the world to meet the Paris climate targets, say some analyses.Credit: Barry Lewis/InPictures via Getty

Many of the world’s biggest oil-and-gas companies have announced huge first-quarter profits, as climate campaigners worldwide protest over the slow progress in transitioning away from fossil fuels.

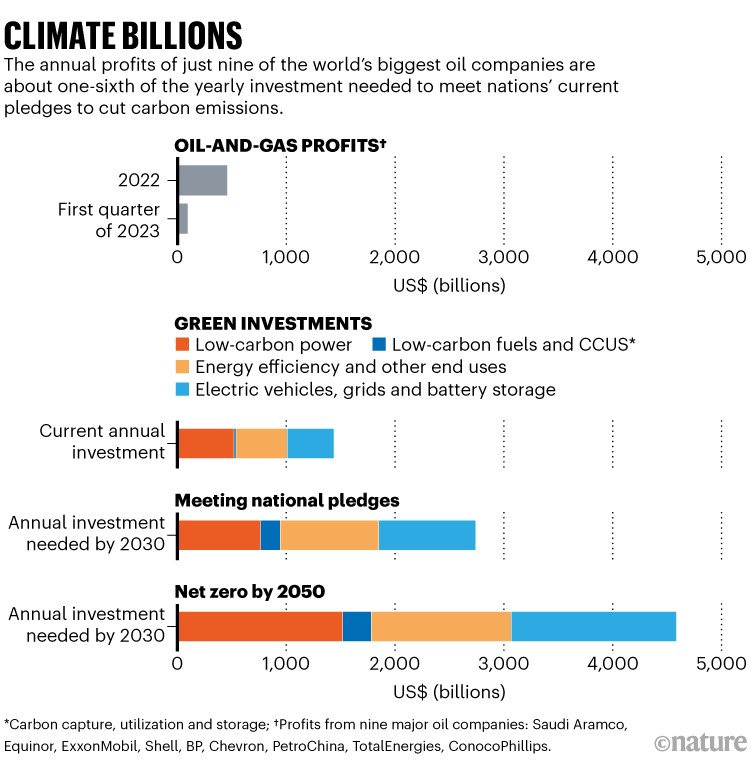

Total profits from nine of the biggest energy companies approached US$100 billion for the first three months of 2023, and annual profits for 2022 from the same firms totalled $457 billion. The yearly profits of just those firms are around one-sixth of the annual investment needed to meet the pledges that governments have made to combat climate change, according to data from the International Energy Agency (IEA).

Climate pledges from top companies crumble under scrutiny

The earnings are larger than usual, which can in part be attributed to the rise in oil and gas prices following Russia’s invasion of Ukraine, and the COVID pandemic, says Charlie Wilson, an energy and climate-change researcher at the Environmental Change Institute at the University of Oxford, UK.

“The profits in the oil-and-gas industries are simply showing how much demand there still is for these commodities,” says Daniel Duma, a researcher at the Stockholm Environment Institute.

Meanwhile, protests against fossil-fuel firms and over the climate crisis have become an almost weekly occurrence in cities worldwide, as groups such as Just Stop Oil and Extinction Rebellion demand more urgent action from governments. In February, activists from the environmental group Greenpeace protested outside Shell’s London headquarters, as the company announced its annual profits. “While Shell counts their record-breaking billions, people across the globe count the damage from the record-breaking droughts, heatwaves and floods this oil giant is fuelling,” climate-justice campaigner for Greenpeace UK Elena Polisano said at the time.

Source: International Energy Agency (green investments); individual company records (oil-and-gas profits).

Getting to net zero

But investments in renewable energy, needed to tackle climate change, by nations to meet their carbon-cutting pledges is falling behind. According to the IEA, an intergovernmental policy group in Paris, to meet existing targets, nations must invest $2.7 trillion annually in clean energy by 2030. To transition to a net-zero world — in which the net amount of carbon emissions produced by humans amounts to nothing, either by reducing emissions or by removing carbon — by 2050 would take $4.6 trillion annually (see ‘Climate billions’) between now and 2030. Current annual spending on green energy is about $1.4 trillion, the IEA estimates.

The hard truths of climate change — by the numbers

And to meet the Paris agreement goal of limiting global heating to 1.5 ºC, $131 trillion is needed between 2021 and 2050, according to the International Renewable Energy Agency (IRENA) in Abu Dhabi, the United Arab Emirates.

Duma wants to know whether current oil-and-gas prices and profits will be the basis for investment decisions that could see fossil fuels still produced for the next 20 or 30 years. “Our research shows that fossil-fuel production must decline immediately for the world to have a chance at meeting the Paris targets,” he says. But, he adds, “Observing the behaviour and decisions of major oil-and-gas-producing countries and companies, the plans are to continue or even expand production”.

Still, Duma is encouraged by investments in renewable power, with rapidly emerging technological improvements bringing cheaper green energy. “Of course, we would like the pace to be faster, and for investments to be more evenly distributed around the globe,” he says.

“Big oil should reinvest its profit in low-carbon-energy infrastructure,” says Wilson, who adds that some countries have tried to encourage this by allowing companies to avoid ‘windfall’ taxes — levied on bumper earnings — if profits are ploughed back into energy-production capacity.

More News

Author Correction: Stepwise activation of a metabotropic glutamate receptor – Nature

Changing rainforest to plantations shifts tropical food webs

Streamlined skull helps foxes take a nosedive