There’s a key chemical connection between many of the technologies that will power the race to net zero carbon emissions. Solar cells use neodymium, dysprosium and terbium to convert sunlight into power efficiently. Light-emitting diodes depend on europium and dysprosium for their luminescence. Neodymium and samarium are ingredients in powerful magnets used in wind turbines and electric motors. All of these elements are part of the group of 17 ‘rare earths’ — the 15 lanthanides on the periodic table, from lanthanum to lutetium, plus scandium and yttrium.

Demand for rare-earth elements (REEs) is growing fast. Around 170 kilograms of REEs are required to generate one megawatt of wind-powered energy, for example1, which is enough to supply about 900 homes in the northeast of the United States. Global use of these elements is projected to rise 5-fold from about 60,000 tonnes in 2005 to 315,000 tonnes in 20301.

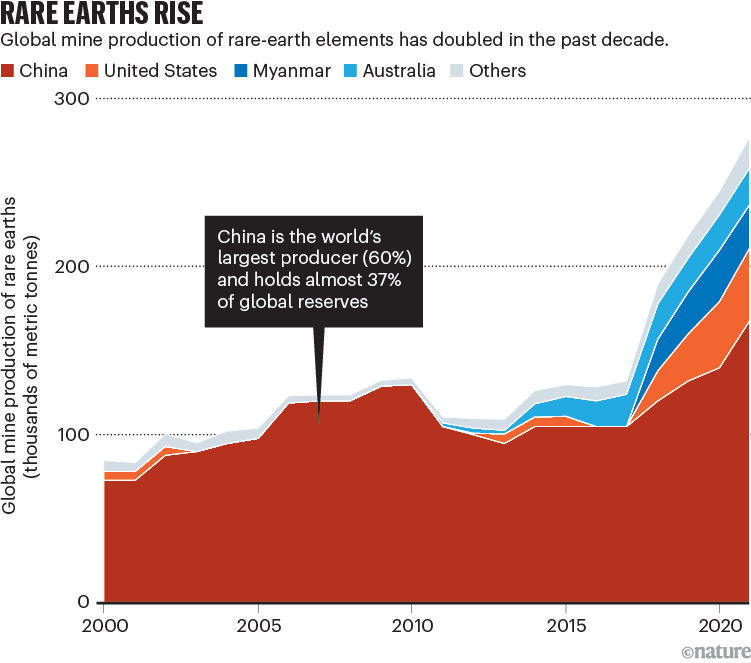

Yet their availability is limited. China, the United States and Russia control 56% of global REE reserves and 76% of their production (see go.nature.com/3h1aeji and ‘Rare earths rise’). For more than a decade, geopolitics, the aftermath of the COVID-19 pandemic and now war have disrupted global supply chains and made prices volatile. In 2020 and 2021, some REE prices tripled or quintupled after almost a decade of relative stability.

SOURCE: US Geological Survey

There is a geopolitical race to control REE resources and for countries to squeeze other nations out. The REE market is a ‘zero sum’ game, in which one nation’s or company’s gain is another’s loss, with no net benefit.

Green industries in the United States and Europe are facing shortages of these crucial materials as they forgo Chinese and Russian exports for political reasons. Many nations are boosting domestic exploration and mining, while restricting sources of imports. For example, in 2022, the US Department of Defense (DoD) awarded a US$35-million contract to MP Materials Corporation, based in Las Vegas, Nevada, to process heavy rare-earth elements at the company’s California production site. In January 2023, Sweden’s state-owned mining company LKAB announced it had found a vast deposit of REEs, which is now Europe’s biggest.

Markets in REEs are also dispersed and inefficient. These elements are niche commodities, produced and used in small amounts, mainly by small- and medium-sized, mostly state-owned businesses rather than the large conglomerates that control steel or aluminium production, for example. REEs are essential for many technologies, such as smartphones, yet the value of the world market in REEs is just 0.18% of that in crude petroleum commodities, putting off investors (see go.nature.com/43avjku). In some parts of the world, such as Myanmar, REEs are traded illegally (see go.nature.com/43e4tzx).

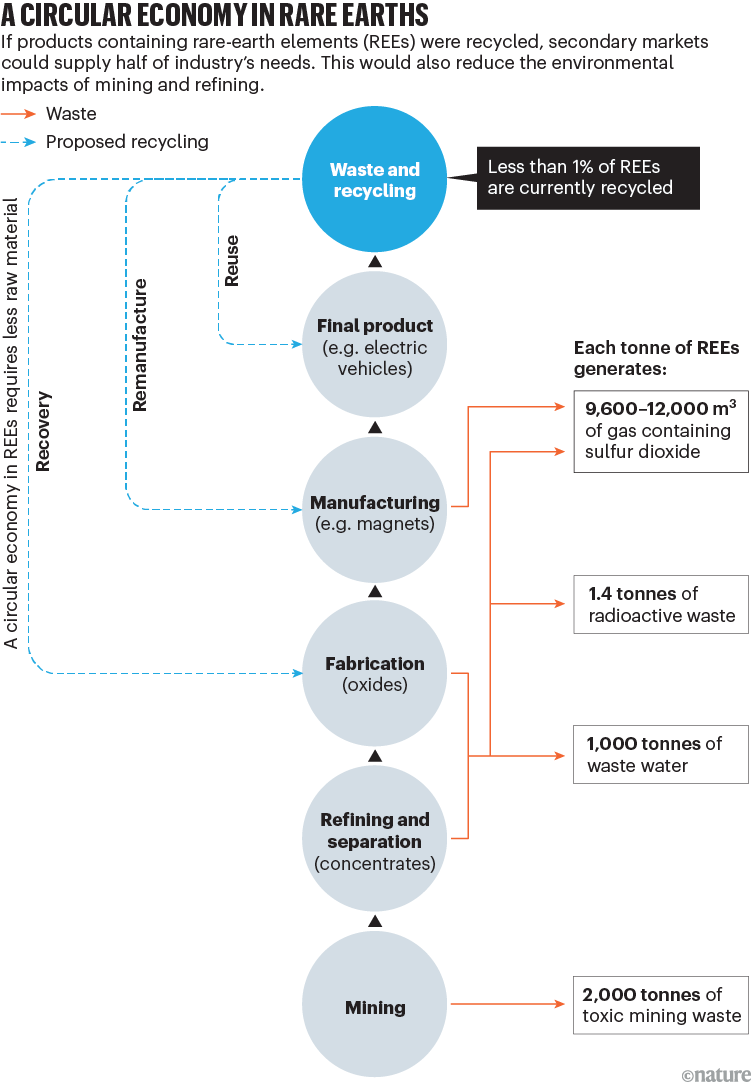

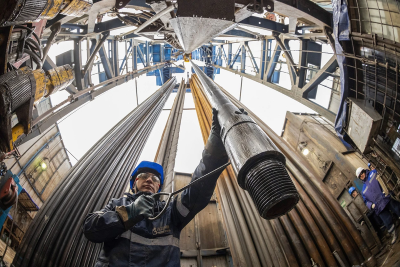

Another complication is that REEs are not mined directly, but are usually extracted from minerals that are by-products of other types of mining, such as bauxite and iron ore. Yet much viable mining waste goes unprocessed. The REE value chain consumes vast amounts of energy and water and releases pollutants and carbon emissions (see ‘A circular economy in rare earths’). Refining one kilogram of REE oxide generates 40–110 kilograms of carbon dioxide (equivalent)2. Refining one tonne of REE oxide can produce 1.4 tonnes of radioactive waste, 2,000 tonnes of waste material and 1,000 tonnes of wastewater containing heavy metals3.

Source: J. Navarro & F. Zhao Front. Energy Res. 2, 45 (2014)

To meet soaring demand without damaging the environment, the whole REE industry needs to be rethought. In our view, this can be done — without winners and losers — by building win–win alliances and a global circular economy for REEs. Here are three priorities.

Boost REE recycling globally

Only about 1% of REEs are currently recycled4. Yet there are clear benefits. Recycling neodymium from end-of-life magnets, for example, takes less than half (35%) of the energy needed to extract it from ores, and releases fewer toxins (see go.nature.com/46crado).

Why is so little recycled? There are no policies or programmes for recycling REEs from products anywhere in the world. And many devices containing REEs in relatively large concentrations, such as electric car batteries and magnets in wind-powered mills, are still in use and years away from being retired. REE-recycling technologies are also immature and economically unfeasible.

Regulatory programmes and policies exist for managing other types of end-of-life material, which could be tailored for REEs. For example, Europe and China have legislated to make manufacturers take back electronic equipment waste. But the main focus of these policies is managing hazardous waste, such as mercury, cadmium and lead, rather than supporting ‘circular economy’ practices of reuse and recycling. Regulations for electrical equipment do not yet cover electric-vehicle batteries and permanent magnets for this reason (see go.nature.com/3xfhxxi).

Researchers at the French Geological Survey separate rare-earth elements from mining waste.Credit: Christophe Archambault/AFP via Getty

Governments worldwide should introduce compulsory take-back policies for products rich in REEs, and build networks of licensed recycling firms to process products containing REEs. Mandatory recycling rates or recycled-content requirements for REEs need to be set, and enforced. For example, the European Commission has passed a law requiring that 15% of REE consumption in the European Union be covered by secondary sources by 2030 (see go.nature.com/3xat92q). Global agreements will be needed for collecting REE end-of-life products from countries lacking recycling facilities.

Governments should also agree to a global standard for product labelling to help manufacturers and others understand the types and amounts of REEs in products. And they should revise existing legislation concerning electrical equipment to include products with dense and rich amounts of REEs, including magnets and electric-vehicle batteries.

Researchers need to assess the feasibility and implications of such policies. For example, how hard will it be for companies to meet a national 15% recycling target without repercussions, such as having to rely on poor-quality secondary sources or export restrictions? What would it take for them to achieve 30%? One stumbling block is that few researchers or industry players know the quantities of REEs in products, or consumption patterns of low-carbon devices, often because of confidentiality issues. This makes it difficult to judge how many tonnes of REEs might become available when products come to the end of their lives, or the time frame for being able to collect them. A data platform to share estimates about the future supply of REEs from secondary sources would help to resolve this gap.

How to make lithium extraction cleaner, faster and cheaper — in six steps

Coordination and reduced tariffs for goods and services related to REEs are needed to overcome global trade barriers and REE export restrictions, which have increased fivefold since 20095. Better alignment of international trade, industrial policy and the United Nations Sustainable Development Goals (SDGs) should include international circularity for REEs. Agreement on such issues at the next G20 meeting, in New Delhi in September, for example, would help to establish international markets and build economies of scale for recycled REEs and reused products. It would also help low- and middle-income countries to access REEs to speed up their energy transitions, and it would help governments to support green-recovery plans after the COVID-19 pandemic through fair trade, while delivering on the SDGs.

Invest to recover and trace REEs

Investments are needed in systems and technologies for tracking REEs, collecting products, automating disassembling technologies, and separating and recovering them. Materials and engineering innovations are required from a range of research on developing and improving microscopic bioleaching technology (to filter minute traces of REEs) to hydrometallurgy and solution-based chemistry methods for collecting REEs during processing of fluorescent lighting in environmentally friendly ways. Such technologies are typically demonstrated in laboratories and need scaling to industrial levels.

Governments should consider tax rebates and subsidies for funding research, development and innovation to drive down costs. Public–private partnerships could raise money for recycling REEs from specific products, such as permanent magnets from hard disk drives, wind-turbine and electronic-vehicle motors, speakers, magnetic resonance imaging machines and satellite communication equipment. In one positive example, the EU intends to mobilize up to €200 million (US$217 million) to create ten new ‘Hubs for Circularity’ to facilitate cross-sector collaboration and increase recovery and recycling of raw materials across the EU6.

The Mountain Pass rare-earth elements mine in California is operated by MP Materials, a US mining company.Credit: Isaac Brekken/The New York Times/Redux/eyevine

Beneficiaries of such public–private partnerships include the conglomerate corporation Hitachi based in Tokyo and government laboratories such as the US Oak Ridge National Laboratory in Tennessee — both are evaluating options for recycling hard disk drives containing REEs. Google is investing in these options as well, fuelled by estimates that materials recovery from US hard disks could eventually meet about 5% of the global demand (excluding China) for neodymium magnets7.

However, the profitability of such processes is low, driven by REE prices and volatility, as well as the trace quantities in which REEs are used: a typical hard disk drive contains a few grams of REEs, or about 1–2% of REEs by weight6. REEs are also present in miniature chips in credit cards, in dopants added to semiconductors to improve electrical conductivity and in fuel additives. Although recovery efficiencies of as much as 99.8% have been reported8, low yields make reclamation unprofitable. More research is needed on driving down costs and stabilizing markets.

Other funding routes are needed to build up a global REEs circular economy. Climate funds, such as the Green Climate Fund established within the UN Framework Convention on Climate Change to assist low- and middle-income countries in adaptation and mitigation to counter climate change, could funnel some investments to REEs recovery, particularly in the transport and digital sectors. Green-city schemes, such as those developed by the European Bank for Reconstruction and Development (EBRD), should include REEs in plans for the collection and recovery of electrical goods. Multilateral development banks could advance financial mechanisms in low- and middle-income countries, in line with the UN SDG Stimulus Plan, which was released in February.

The US should get serious about mining critical minerals for clean energy

International trade and price monitoring will be essential to maintain fairness, and market transparency will attract further investment. Organizations such as the Global Rare Earth Industry Association (REIA) should support these efforts by setting up, for example, an international knowledge hub to track and forecast stocks of raw and secondary REEs.

Infrastructure to help trace amounts of REEs at individual product levels would boost secondary markets and circular-economy practices in the long run. Currently, REE trace ingredients are not even listed in the bill-of-materials for products. Research on traceability, for example using blockchain technology — a distributed data-management system — would improve the management of REE product flows9. Open-access or blockchain-supported databases for tracking REE product flows will also be needed. Research into technologies for sensing the molecular footprints of REEs in materials need to be developed. Designs and tools will be needed to maintain, operate, manage and share these distributed REE big-data platforms. Industry standards will also be crucial.

Rework REE supply chains

Further research will also be needed into designing business models and supply chains. For example, what is the optimal logistics network? How can resilient supply chains for REEs be made for key industries under different macro-economic outlooks?

Business models could be lucrative. Tracing systems can enable the leasing of REE minerals10 — a system in which these minerals are not sold, but rented out for a period of time. Legal, contractual and process barriers remain, however. One big challenge is determining who should own the REE materials, as well as the environmental services in a supply chain. Should it be the original mineral extractors that typically operate in low-income regions, or the high-value-adding manufacturers based in privileged regions? What if the leases are owned by parties who are corrupt? Should a reprocessor positioned between a final customer and secondary market be able to claim ownership?

Energy crisis: five questions that must be answered in 2023

REE end-user companies have an interest in maintaining ownership of recycled materials. The policies and practices of organizations throughout future supply chains will need research and adjustment, including development of recycling infrastructures, finance, platforms, traceability and information-sharing standards. Considering service-provision and leasing models for REEs could mean new trade agreements, in which tracing technologies should be applied. Countries that conduct their own materials management from extraction to manufacturing might be able to have internal systems, but cooperation on global systems would require carefully set standards and international law agreements.

Global collaboration might not be as difficult as imagined, in this era of reshoring and domestic focus. Some countries might find it attractive to stop smuggled REEs coming in and to add value to global industrial networks. Collaboration between China, the EU, the United States and other nations could be fostered by constructing an international REE database with forecasts, developing fair trade of REEs and other standards. Such collaboration could rekindle international trade and broaden global partnerships on energy transitions. Circular-economy policies and practices can mitigate concerns about REEs and erode the zero-sum mentality.

More News

How I fled bombed Aleppo to continue my career in science

Powerful ‘nanopore’ DNA sequencing method tackles proteins too

US funders to tighten oversight of controversial ‘gain-of-function’ research