CNN

—

CNN Underscored reviews financial products such as credit cards and bank accounts based on their overall value. We may receive a commission through the LendingTree affiliate network if you apply and are approved for a card, but our reporting is always independent and objective.

The Chase Freedom Flex credit card features a set of bonus categories that rotate every three months. You can earn 5% cash back in these rotating categories, up to $1,500 in combined purchases each quarter, making them a lucrative source of credit card rewards.

The bonus categories for the second quarter of 2021 are gas stations and home improvement stores, meaning purchases made with your Chase Freedom Flex card at any merchant in those categories from April 1 through June 30 can earn bonus cash back.

But in order to earn bonus cash back in these categories, there’s one vital step you can’t skip: Each and every quarter, you must activate the categories. And the deadline to activate for this quarter is today, June 14, 2021.

The good news is that even if you forgot to activate the categories before making purchases on your Chase Freedom Flex card, it’s not too late. Activating the categories now will still retroactively count for all the purchases you’ve made in those categories since April 1, so long as you activate by the deadline.

If you have a Chase Freedom Flex card, there are three ways to activate the bonus categories:

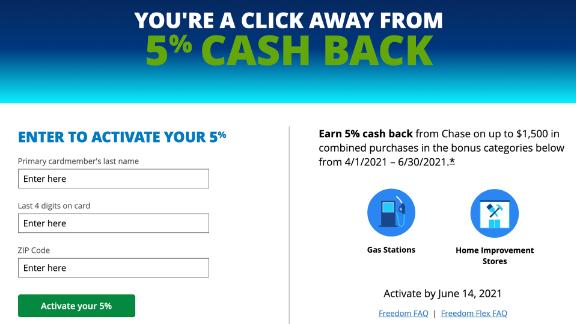

Most people will activate their bonus categories online, which is an extremely simple process. All you’ll need to enter are the last four digits of your Chase Freedom Flex credit card, your last name and your zip code.

Chase

You can activate the Chase Freedom Flex bonus categories online in just minutes.

Then click the “Activate your 5%” button and you’ll get a confirmation screen indicating that you’re all set. Just remember that if you have more than one Chase Freedom Flex card, you’ll need to activate each one separately.

Earning 5% cash back on your credit card is a great return, but there’s a way to get even more out of these bonus categories. If, in addition to your Chase Freedom Flex card, you also have a Chase Sapphire Preferred Card or a Chase Sapphire Reserve, it’s possible to convert any cash back earned with your Chase Freedom Flex into Chase Ultimate Rewards points instead.

What’s the advantage of having Ultimate Rewards points instead of cash back? Well, when you have one of the two Sapphire cards, you can redeem those points for more than you’d get by just taking cash back.

You’ll get 1.25 cents per point in value when you have the Chase Sapphire Preferred and redeem points for travel, or through Chase’s “Pay Yourself Back” tool through September 30, 2021, which right now includes the ability to use points for purchases at grocery stores, dining establishments (including delivery and takeout) and home improvement stores.

And if you have the Chase Sapphire Reserve, you’ll get 1.5 cents per point in value when redeeming for travel or using the “Pay Yourself Back” tool in those categories through September 30, 2021. That’s 50% more than you’d get if you just kept your Chase Freedom Flex rewards as cash back instead of using them as points.

Related: Chase Sapphire Preferred vs. Chase Sapphire Reserve: Which is best for you?

Finally, with either Sapphire card, you have the ability to transfer points to Chase’s 13 transfer partners, which include airlines like United and Southwest, and hotel chains such as Hyatt. Having this flexibility as travel resumes broadly can get you some pretty sweet flights and hotel rooms for little to no cost.

If you don’t already have a Chase Freedom Flex card, it has a pretty nice sign-up bonus right now for new customers. You can earn $200 in bonus cash back after spending $500 on purchases in the first three months after opening the account.

In addition to the rotating bonus categories, the card also comes with a trio of fixed bonus categories: 5% cash back on travel purchased through Chase Ultimate Rewards, 3% cash back on dining (including takeout and delivery) and 3% cash back at drugstores.

And if you have an original Chase Freedom card — meaning the non-Flex type — existing card holders still have access to all the original card benefits, including the rotating categories. That means you can hang onto the card and keep scoring bonus cash back every quarter. You can even apply for a new Chase Freedom Flex card as well, as customers are allowed to have both cards at the same time.

So, if you haven’t already, take two minutes right now to find your Chase Freedom Flex card, and enter the information at chase.com/freedomflex before the activation deadline expires on June 14. There’s no reason to wait — if you do, you could miss out on some pretty great extra rewards.

Learn more and apply for the Chase Freedom Flex card.

Find out which cards CNN Underscored chose as its best credit cards of 2021.

Get all the latest personal finance deals, news and advice at CNN Underscored Money.

More News

Fewer U.S. Adults Say They Will Have Children, Study Finds

In Japan, Turning the Tables on Rude Customers

Firefighters Race to Contain Wildfires in California and Oregon