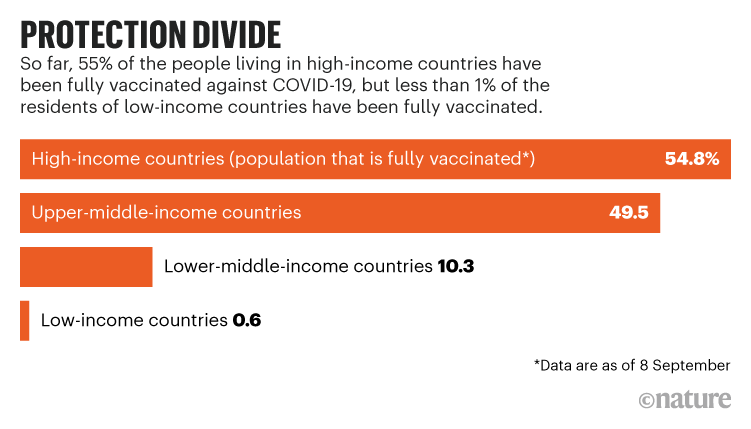

Vaccines against COVID-19 are not reaching many people in the global south, despite donations from wealthy nations. Less than 1% of people in low-income countries are fully vaccinated, and just 10% are in lower-middle-income countries, compared with more than half in high-income countries.

Many researchers say the best way to ensure equitable access to COVID-19 vaccines is to enable countries in the global south to make their own. “Charity is good, but we can’t rely on charity alone,” says Peter Singer, an adviser to the director-general of the World Health Organization (WHO).

Since last year, health-advocacy organizations have been pressing pharmaceutical companies and governments that developed highly effective vaccines to share their patented knowledge and technology with drug manufacturers that could produce them for poorer countries. These vaccines include the messenger-RNA jabs created by Moderna in Cambridge, Massachusetts, and Pfizer in New York City and BioNTech in Mainz, Germany, and a viral-vector vaccine developed by Johnson & Johnson (J&J) in New Brunswick, New Jersey.

Calls to manufacture more vaccines in the global south have grown louder in advance of high-level pandemic discussions at the United Nations General Assembly, which began this week, and a US-led, Global COVID-19 Summit on 22 September. Advocates are clamouring for a variety of approaches. Some had pointed to the deployment of the Sputnik V vaccine as a model of pandemic diplomacy. Russia broadly licensed the jab to 34 drug companies outside its borders, including several in India and Brazil. But manufacturers are now saying that the second dose of the vaccine — which has a different composition than the first — is difficult to produce in large quantities.

In a letter signed by several Indian civil society groups — shared with Nature — advocates are urging US President Joe Biden to compel J&J to partner with drug companies in the global south, arguing that those making Sputnik V could easily pivot to the J&J vaccine because they rely on similar technologies. They estimate that the transition would take less than six months.

Achal Prabhala, an author on the letter and a coordinator at AccessIBSA, a medicines-access initiative in Bengaluru, India, thinks this switch would help to quickly protect people in places lacking vaccines (see ‘Protection divide’). He adds that partnerships with the companies that developed mRNA vaccines will also be crucial because of the shots’ effectiveness and adaptability. India, in particular, could help to tame the pandemic if the country was enabled to make more shots, he says, illustrated by its role in providing the majority of vaccines against other diseases to low- and lower-middle-income countries. “For 3.9 billion people, we are the bulwark of vaccine manufacturing. So, if there aren’t contracts here, the world suffers.”

Such calls have not yet gained traction. Outside of deals to bottle and package their vaccines, J&J has only one partnership with an Indian company, and Pfizer, BioNTech and Moderna have none in India, South America or Africa. Pharmaceutical companies have cited reasons including quality concerns and the time required to get new companies up to speed. Instead, they say they’re ramping up their own production, and they ask wealthy nations to increase vaccine donations to poorer ones. Prabhala calls their arguments “a useful canard that obscures the real barrier — an unwillingness on the part of western pharmaceutical companies to relinquish control over their patents and technology, even at the cost of millions of lives”.

Although the Biden administration supported a waiver on intellectual property surrounding COVID-19 vaccines that was proposed by India and South Africa at a World Trade Organization meeting last October, action has stalled. And the administration has not pushed US companies to partner with those in the global south. Germany, which funded the development of BioNTech’s mRNA vaccine, later licensed to Pfizer, remains opposed to patent waivers.

As months pass, some researchers have stopped hoping for partnerships to come to fruition. A group in South Africa has decided to try and re-create existing vaccines. Others argue that funds would be best spent on getting manufacturers in the global south prepared to pump out the next generation of vaccines currently in clinical trials. Most global health researchers agree that regional manufacturing is the only way to ensure worldwide vaccination in a crisis. Shahid Jameel, a virologist at the Trivedi School of Biosciences at Ashoka University in New Delhi, says, “We can’t fix vaccine inequalities until vaccine manufacturing is distributed.”

Low yields

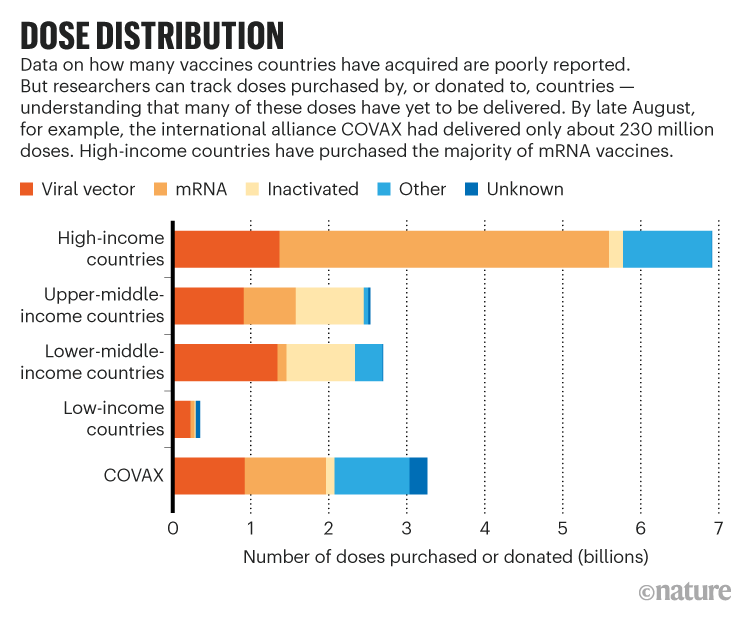

Companies might produce an estimated 12 billion doses of COVID-19 vaccines this year, but many more are needed, says Andrea Taylor, a global health researcher who leads a vaccine-tracking project at Duke University in Durham, North Carolina. Many wealthy nations have purchased enough doses to cover their populations several times over while some countries have very few, she says. The type of vaccine in demand has shifted, too. China’s vaccines, made from inactivated SARS-CoV-2 coronaviruses, accounted for nearly a third of jabs in lower-income countries through August. But questions about the shots’ efficacy have some countries searching for other options. Meanwhile, demand for mRNA vaccines has soared because wealthy countries are recommending third doses to, in theory, boost their populations’ immunity (see ‘Dose distribution’).

Lacking mRNA options, many nations in the global south rely on viral-vector shots that use a harmless inactivated virus to deliver their payload to cells. Indeed, 88% of the people vaccinated in India have gotten viral-vector shots developed by the University of Oxford and AstraZeneca in the United Kingdom — and produced by the Serum Institute of India, the biggest vaccine manufacturer in the world. International organizations leading COVID-19 Vaccines Global Access (COVAX), a system to supply COVID-19 vaccines to low- and middle-income countries, expected the Serum Institute to provide a bulk of their of vaccines, but that plan fell short when the Indian government restricted exports in March when the country faced a deadly surge of COVID-19 and only 2% of its population had been vaccinated. Because of issues including the export pause and a lack of donations, COVAX has shifted its goal of delivering two billion doses from this year to 2022.

Russia’s Sputnik V vaccine can’t bolster COVAX’s supply because it isn’t authorized by the WHO, despite its authorization in India, Brazil and dozens of other countries. The organization has given the green light to J&J’s jab, however — another reason that advocates support a transition to that shot. Handing off Sputnik V wasn’t simple, but manufacturers say the technology transfer process is instructive. Russian scientists gave willing drug companies essential ingredients for the vaccine and lists of equipment and supplies, and they visited the plants to teach them the manufacturing process.

Hemanth Nandigala, the managing director of one company producing Sputnik V, Virchow Biotech in Hyderabad, India, says that such “hand holding” made the technology transfer faster — about three months — although scaling production, passing regulatory clearances and commercialization has taken another five months. Only in September had it become clear that many companies making Sputnik V have low yields for the second dose. The vector in the first shot — adenovirus 26 — is similar to that in J&J’s vaccine, so Nandigala says that, if enabled, companies could reorient their processes to produce this jab.

J&J did not respond to requests from Nature about why it has not partnered with more companies in the global south. However, at a 7 September press briefing, J&J’s chief scientific officer, Paul Stoffels, explained that transferring technology requires time to train a workforce to produce new and complex products. The company has partnered with one Indian company based in Hyderabad: Biological E. Its managing director, Mahima Datla, says that the transfer and scale-up took around seven months, and they hope to soon produce more than 40 million doses monthly. It’s not clear how many of those J&J vaccines will serve lower-income countries. “The decision on where they will be exported, and at what price, is under the purview of J&J completely,” she says.

In South Africa, J&J’s partnership with a pharmaceutical company in Durban that bottles its vaccines caused controversy after The New York Times reported that it was shipping the shots to Europe, despite more than 90% of people in South Africa having received no vaccine at all. Following the outcry, J&J said that future doses produced in South Africa would stay in Africa.

Faced with J&J’s reluctance, the authors of the letter from India argue that the US government gave the company $1 billion to develop their technology, and could therefore compel it to increase its output by partnering with the 34 firms outfitted for Sputnik V. “If US President Biden is indeed serious about vaccinating the world, his administration has the moral, legal, and if necessary, financial power to lift intellectual property barriers and persuade J&J to license its vaccine, with technology and assistance included, to every manufacturer currently engaged in making the Sputnik V vaccine,” they write.

Unsatisfied with leftovers

When it comes to mRNA vaccines, researchers say transferring the knowledge and acquiring tools required for manufacturing will be challenging because of the newness of the technology. Nonetheless, Aditya Kumar, a representative for India’s Stelis Biopharma in Bengaluru, which is producing Sputnik V, says that the steep learning curve would be worthwhile because mRNA vaccines seem to be simpler to make in large quantities than those based on viral vectors — a finicky process that requires researchers to grow adenoviruses in living mammalian cells. “Manufacturers like us are always considering how to scale vaccines because we understand the massive needs of the underserved world,” he says.

For several months, the WHO has called on companies to share their licenses. At a press briefing last week, WHO director-general Tedros Adhanom Ghebreyesus said, “I will not stay silent when the companies and countries that control the global supply of vaccines think the world’s poor should be satisfied with leftovers.”

Specifically, Soumya Swaminathan, the WHO’s chief scientist, has asked innovating firms to contribute their intellectual property to the Medicines Patent Pool, a United Nations-backed organization that aims to bring inexpensive drugs to poor countries. The group helps companies to forge partnerships by identifying reliable manufacturers, assisting with regulatory approvals and finding licensing arrangements that offer vaccine developers royalties on drugs sold.

But the pharmaceutical industry hasn’t played ball. Thomas Cueni, the director-general at the International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), says the surest way to scale up manufacturing is to do it in-house. “It comes down to quality control and quality assurance, which is incredibly complex,” he says, wherever you are in the world. “People can talk about additional partnerships, but they underestimate the challenge.”

The chair of the patent pool, Marie-Paule Kieny, disagrees, pointing out that many researchers in her group previously worked at leading pharmaceutical firms, and have experience ensuring best practices. “The Medicines Patent Pool does not give licenses to manufacturers working in a garage,” she says.

Another approach, Swaminathan says, is for companies to participate in a technology transfer hub in South Africa — announced by the WHO in June — where researchers who developed mRNA vaccines can teach other manufacturers how to make them. But Pfizer’s chief executive officer, Albert Bourla, knocked the initiative at an IFPMA press briefing last week, suggesting it would take “years” for companies to get up to speed. He added that vaccine supply won’t be a problem next year, once Pfizer and other firms have ramped up manufacturing. In an e-mail to Nature, a spokesperson for Pfizer explained that the company has initially relied on manufacturers in Europe and the United States to safely ramp up production, but might bring on more manufacturers in the future so that it can make up to four billion doses in 2022. Moderna did not respond to requests for comment from Nature. But its chief executive, Stéphane Bancel, told analysts in May that he was strongly opposed to patent waivers, and that outside companies would take upwards of 12 to 18 months to produce Moderna’s mRNA shot.

Suhaib Siddiqi, a former director of chemistry at Moderna, based in Boston, Massachusetts, contests these long timelines. He argues that Moderna tested the efficacy of its vaccine and scaled up production within nine months, and therefore could teach experienced drug companies in India how to do the same. The WHO may share Siddiqi’s confidence: Yesterday, Reuters broke the news that the South African hub will attempt to re-create Moderna’s shot. Swaminathan confirms the report, adding that researchers familiar with the process have offered to assist.

An advocacy group based in Washington DC, Public Citizen, argues that the US Department of Health and Human Services (HHS) could help the WHO, too. They assert that HHS has rights over such information because the government invested US$1.4 billion in the vaccine’s development in 2020, in exchange for “access to all documentation and data” generated under a publicly available contract with Moderna. HHS declined to comment to Nature on the terms of the contract and Public Citizen’s request.

An easier path?

Instead of holding out for today’s popular vaccines, some researchers hope that those in clinical trials will be easier to license and make in the global south. At the top of the list are protein-subunit vaccines, in which peptides matching those from SARS-CoV-2 teach the immune system to recognize the virus and fight it off. Researchers say the benefit of such vaccines is that vats of yeast or insect cells can churn out huge quantities of peptides, making the vaccines scalable. They add that many companies are familiar with the process because they produce vaccines for other diseases and recombinant drugs in a similar fashion.

One of these is a product from Biological E, which licensed the technology from Baylor College of Medicine and Texas Children’s Hospital in Houston, Texas. Biological E’s vaccine is currently in phase 3 clinical trials in India, and Datla expects it to be authorized by the Indian government by November and the WHO in January. Prashant Yadav, a health-care supply-chain specialist at the Center for Global Development in Washington DC, argues that it’s worth waiting to see whether this type of vaccine is effective, because transferring the technology and scaling up production might be simpler than moving the needle with other companies. “If the protein-subunit vaccines work well, I’d put my money there,” says Yadav.

But how a fresh set of companies will license their vaccines to external manufacturers remains to be seen. Peter Hotez, a vaccine researcher who helped to develop the subunit vaccine at Baylor, says they aren’t putting patent restrictions on the technology, so that manufacturers in India, Indonesia and elsewhere can make billions of doses next year for the developing world. He says, “We’re receiving calls weekly from low- and middle-income countries desperate for our vaccine.”

More News

Monsoons are changing in India — here’s how to climate-proof the economy

The AI revolution is coming to robots: how will it change them?

Risks of bridge collapses are real and set to rise — here’s why