Demand for lithium is soaring. The element is a crucial ingredient in green technologies, including batteries in phones, laptops, electric cars and electricity grids1,2. Lithium ion batteries are among the best options for holding charge and delivering power efficiently. By 2025, demand for elemental lithium is set to be three times higher (150,000–190,000 tonnes) than it was in 20183. And by 2100, that could rise to 400,000–700,000 tonnes per year4.

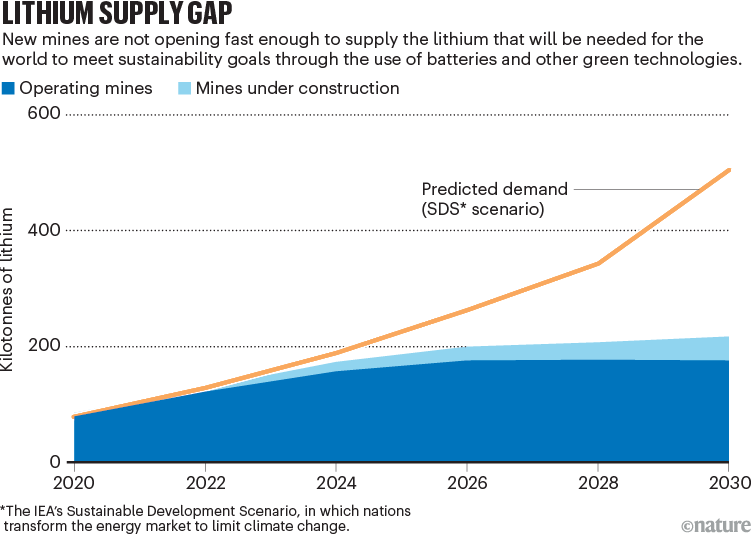

In theory, there is enough lithium in the ground to meet that need — roughly 20 million tonnes (Mt) are available in reserves where the element is economic to extract, and nearly 90 Mt more resources have been identified elsewhere5. But, in practice, there is a production bottleneck. It is slow and expensive to open new mines and processing facilities, so demand could outstrip supply in the next decade (see ‘Lithium supply gap’). The International Energy Agency (IEA) predicts that, by 2030, producers will be able to deliver only half of the lithium industry’s needs while meeting sustainability targets that are in line with the Paris climate agreement6.

Source: IEA

The methods used to mine and process lithium from rocks, brines and clays are also not up to scratch. They have changed little over the past century, and rely on mechanical and chemical processes that are inefficient, wasteful and damaging to the environment. The whole basis of lithium mining and processing needs to be rethought.

Conventionally, rocky ores are roasted at 1,100 °C and then baked in acid at 250 °C to liberate (‘leach’) lithium in its sulfate form (Li2SO4)7. A similar procedure is used for clays8. Next, undesired metals are separated out using half a dozen chemical reactions, which require more heat and reagents. Finally, the solution is evaporated to leave pure lithium carbonate (Li2CO3) or lithium hydroxide (LiOH). Brines are treated similarly, or can be left outside to evaporate for months to a year — a rate that is too slow to boost the industry.

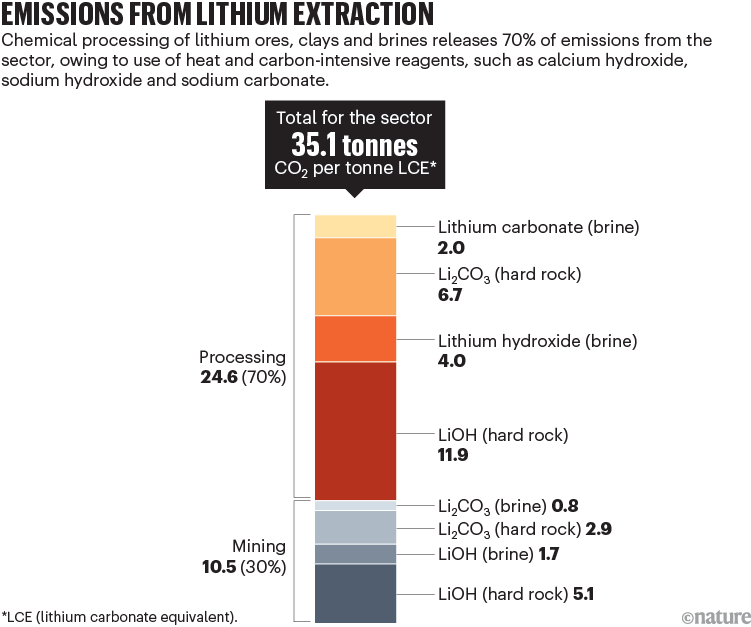

Chemical processing of lithium also consumes a lot of energy and water: producing 1 tonne of lithium salts requires roughly as much electricity as six US homes use in a year (60 megawatt hours), as well as a small swimming pool’s worth of water (70 cubic metres). It generates a lot of solid waste9 and emissions. Depending on the feedstock, producing 1 tonne of Li2CO3 or LiOH releases between 3 and 17 tonnes of carbon dioxide — 2 to 11 times that for 1 tonne of steel, and more than a round-trip flight for one passenger from San Francisco to New York City (roughly 1.5 tonnes of CO2). All told, processing accounts for about 70% of CO2 emissions associated with lithium production6; mining and transport are responsible for the rest (see ‘Emissions from lithium extraction’). By our calculations using IEA data, this totalled 3.6 million tonnes of CO2 in 2020 for Li2CO3. By 2050, the IEA data suggest those emissions could grow to 60 million tonnes of CO2 per year.

Source: IEA

Expansion of mining also has a lot of downsides. Most of the world’s lithium comes from a few remote regions5. More than half (54%) is mined in Western Australia from hard rock ‘spodumene’ ores. Brines are the next most common source, found in surface pools and geothermal springs in the salt flats (salars) of the ‘lithium triangle’ between Chile, Bolivia and Argentina, and in California. Lithium-bearing clays have also been identified across the Mojave Desert in southern California, southern Nevada, Mexico, Serbia and Tanzania.

These predominantly dry regions already experience water stress, which is compounded by climate risks, including extreme heat and flooding. Floods can spread pollution to nearby water bodies. For instance, debris or ‘gangue’ left in evaporation ponds contains heavy metals, such as arsenic, thallium and chromium, as well as uranium and thorium, naturally occurring radioactive elements that are also present in lithium ores.

The adverse social consequences of mining range from inadequate safety and health protections to human-rights violations. It will be essential for lithium-mining companies to uphold the strong environmental, social and governance commitments many have made to continue to protect the environment and the health of workers and local residents (see, for example, go.nature.com/3k3qfbb).

If nothing changes, simply ramping up lithium production at existing sites could negate the benefits of the clean technologies they power. Here, we highlight six priorities for the lithium industry.

Extract lithium in fewer steps

Direct extraction of lithium from brines or acidic solutions avoids the need for many chemical reactions and consumes less raw material, water and energy. Chemists and engineers are piloting such systems, although most have yet to be commercialized. These use a ‘sorbent’ — often a porous metal oxide — to attract and concentrate lithium ions in a column10. The ions are flushed out using hydrochloric or sulfuric acid (H2SO4), and the sorbent can then be reused.

Energy crisis: five questions that must be answered in 2023

Electrolysis is another way to save on reagents and emissions. Conventionally, Li2SO4 solution is converted into battery-grade lithium salts by reacting it with sodium carbonate (Na2CO3) to make Li2CO3 and then with calcium hydroxide (Ca(OH)2) to form LiOH. But both reactants are carbon intensive to produce. Passing an electric current through the solution instead produces reactions at the electrodes. At the positive electrode, water is converted into protons (H+) and oxygen (O2), and at the negative electrode, water turns into hydroxide (OH) and hydrogen (H2). Li+ ions migrate to the negative electrode, where they combine with hydroxide ions to make LiOH. The protons made at the positive electrode then combine with the leftover sulfate (SO42−) to create H2SO4, which can be recovered.

These processes still need to be optimized. Chemists should design sorbents that can take up lithium selectively, quickly and effectively while not deteriorating; those available today are unable to combine these qualities. In electrolysis, electrode materials need be more sustainable, affordable and stable at high temperatures. For example, some elements that are used to coat electrodes, such as iridium, degrade above 50 °C and should be avoided. Different designs, sizes and geometries of electrodes and reactors need to be explored.

Convert waste into valuable commodities

In 2030, the lithium-ion battery industry is projected to produce nearly 8 million tonnes of sodium sulfate (Na2SO4) waste, growing to almost 30 million tonnes by 2050 (A.Z.H., personal communication). This is generated during the crystallization of Li2CO3, when Li2SO4 reacts with Na2CO3. Currently, the waste is dumped in landfill or shipped overseas, making disposal a major challenge. An enormous environmental opportunity therefore exists for reprocessing Na2SO4 back into sodium hydroxide (NaOH) and H2SO4. These chemicals represent two of the largest inputs to lithium mining, battery manufacturing and recycling11, which are likely to use 5 Mt of NaOH and 6 Mt of H2SO4 in 2030. By 2050, that is predicted to increase to 17 Mt and 19 Mt, respectively (authors’ analysis using GREET software developed by Argonne National Laboratory).

Lithium sulfate separation in Bolivia.Credit: Gaston Brito Miserocchi/Getty

Here, again, electrolysis can be used through a process analogous to that for converting lithium salts. As well as adding value to waste, this extra step would enhance the circularity, sustainability and robustness of the lithium-ion battery supply chain. (Multiple companies of various sizes are focusing on this area, including Aepnus Technology, where L.H., B.A. and G.P. work.) According to industry analyses, doing so could mitigate at least 160 million tonnes of CO2 between 2024 and 2050. Costs vary, but could be less than US$1,000 per tonne, thereby reducing processing and disposal costs by at least 15%.

Process minerals electrochemically underground

Rather than digging out rocks and separating chemicals from them at the surface, lithium might be extracted while they are still buried, using electrochemical processes. Horizontal wells drilled through lithium-rich geological deposits can be ‘fracked’ in a similar way to shale oil beds. Inserted electrodes would split water molecules and produce the H+ ions needed to leach lithium into solution. The resulting liquid would be fed to the surface and processed into lithium salts.

Electric cars and batteries: how will the world produce enough?

Subsurface mining technologies are still in their infancy, but the feasibility of this approach has been established for copper recovery12, a process that also relies on acid leaching. More research is needed on how to extract ions such as lithium selectively in a natural environment, among complex materials, surfaces and interfaces. To validate this approach, engineers need to examine correlations between fracture depth and particle size, together with operating conditions such as cell voltage and current density.

Detractors might suggest that electrochemical fracking could worsen water and environmental contamination. However, lithium ores or clays would be fractured at a shallower depth than are deep oil shales. And water and sand could be used as the fracking liquid, without the litany of chemical surfactants and stabilizers required for shale fracturing. Still, economic modelling and life-cycle analysis will be crucial to affirm the viability of subsurface mining, as well as its effects on carbon (both emitted and stored in soils) and ecosystems.

Make electrodes out of raw ores

Battery manufacturers currently synthesize lithium-ion electrode materials from scratch, using pure lithium and transition-metal salts. Making electrodes from less-processed or even raw materials, such as the ores themselves, would avoid much chemical processing. Future electrode chemistries might one day make this possible.

For example, some electrodes are made of layered lithium nickel manganese cobalt oxides (Li-NMC). Materials that have more irregular structures than Li-NMC are being investigated for use as electrodes, including disordered rock salts (DRX). These contain manganese or titanium — elements that are more abundant and less expensive than cobalt or nickel, and can hold charges more densely than Li-NMC can13. But DRX electrodes must be operated at high voltages, at which they become unstable. This problem must be overcome before such materials can be used in batteries.

Recycling of lithium-ion batteries at a facility in Kingston, Canada.Credit: Christinne Muschi/Bloomberg/Getty

In theory, it should be viable to make electrodes directly from lithium ores or clays. Such ores are rich in other elements that are already used in battery electrodes. For example, spodumene includes lithium, aluminium, silicon and magnesium, and lithium clays such as hectorite contain lithium, magnesium, iron and manganese — just not in the right arrangement and environment for storing charge.

Although the concept is still a decade away, chemists and engineers are exploring the possibilities. Computational modelling is needed to examine networks of reactions that might be used for concentrating lithium and transition metals in the ores and identifying useful additives. DRX electrodes and electrolytes (the buffer between electrodes) also need to be developed that can withstand heat and work at high voltages.

Expand mining alongside recycling globally

To overcome lithium bottlenecks, the ‘where’ might be just as important as the ‘what’. Although a handful of countries mine lithium, the battery supply chain is concentrated in east and southeast Asia, especially China. Other nations and regions are looking to boost domestic manufacturing and diversify their supply chains. The European Union adopted a strategy on battery supply chains in 2018 (the European Battery Alliance), and in 2021–22, the United States passed the Bipartisan Infrastructure Bill, the Inflation Reduction Act and the CHIPS and Science Act to boost domestic production of green technologies, including batteries.

Ten years left to redesign lithium-ion batteries

In the long run, commissioning more mines and processing facilities is the simplest way to protect energy security. Although this is beginning to happen, mining and energy infrastructure projects are slow — it takes an average of 16 years from discovery to first production, depending on the types of mineral, location and mine6. Regulatory hurdles also confound this timeline. In the short term, economic scarcity breeds innovation: using fewer materials and substituting elements can alleviate strains on supply and reduce costs. For example, halving the use of silver and silicon in solar cells over the past decade has helped to speed their deployment and lower costs.

Less-concentrated, non-conventional sources of lithium should be tapped, including mine tailings and acidic mine drainage waters, as well as ‘production waters’ from oil and gas drilling. The economics of such approaches need bench- and pilot-scale studies to assess their feasibility.

Recycling of lithium-ion batteries should also be ramped up, not least to address the surge in spent electric vehicle batteries due to reach end of life after 2030. Recycling could provide 10% of supply in 2040, according to the industry6. The core technologies are established. In the simplest form, the electrodes are removed and ‘refreshed’ by adding more lithium to them. More often, the battery is mechanically shredded and heated to release a metal alloy, including cobalt and nickel, and a slag containing lithium and other metals. The slag is then treated much like ores and clays to produce lithium salts. As with raw lithium extraction, chemists and engineers need to help each metal ion to find its home and tailor extraction processes to reduce steps and the use of reagents.

Coordinate policies, boost research and communicate

Growing demand for minerals to help with the world’s energy transition will bring risks for companies, governments and communities. Supply chains must be free from bad actors, and minerals and materials must be responsibly sourced. Digitized documentation, such as ‘passports’ that track the provenance of all minerals and components used in manufacture, is increasingly making it easier to follow products and flows of materials. Origins could be checked by analysing isotopes, using mass spectrometers and databases of the isotopic composition of lithium across geographical sources. Sample preparation and analysis methods would need to be standardized and regulations brought in. Global requirements could be incentivized by trade agreements and economic support packages.

Technical innovation is another area that is ripe for coordination. Government-funded research hubs should be developed with private industry to target research in mineral extraction, similar to those in sectors for water management (such as the US National Alliance for Water Innovation) and semiconductors (such as the Center for X-ray Optics at Lawrence Berkeley National Laboratory in California). Academic innovation hubs should support clean-tech companies. Large companies might set up venture capital firms to support early concepts, which are often deemed too risky by shareholders.

Community consultations are essential to support ‘energy justice’. For example, in southeastern California, the Imperial County Board of Supervisors has led a workshop and proposed others to foster discussions between citizens and industry around local lithium extraction. International bodies, such as the Organisation for Economic Co-operation and Development (OECD), provide a forum for guiding policy actions around energy security.

The lithium challenge represents a rare opportunity in which the needs of fundamental research and global policy are aligned. Incentivizing these six industry shifts will be essential for rolling out green technologies this century.

More News

Editorial Expression of Concern: Leptin stimulates fatty-acid oxidation by activating AMP-activated protein kinase – Nature

Quantum control of a cat qubit with bit-flip times exceeding ten seconds – Nature

Venus water loss is dominated by HCO+ dissociative recombination – Nature